Too many times the terms “custody” and “safekeeping” are used interchangeably, these services differ significantly. Local government investors should understand these distinctions and select the service level that best meets their needs.

As we know, the priority for government investment management is the safety of public funds. A critical safeguard against fraud is the separation of the safekeeping function from the investment function. To address this, investment policies should incorporate clear guidelines on safekeeping and custody, specifying that government securities must be held by an independent third party. This minimizes the risk of fraudulent transactions.

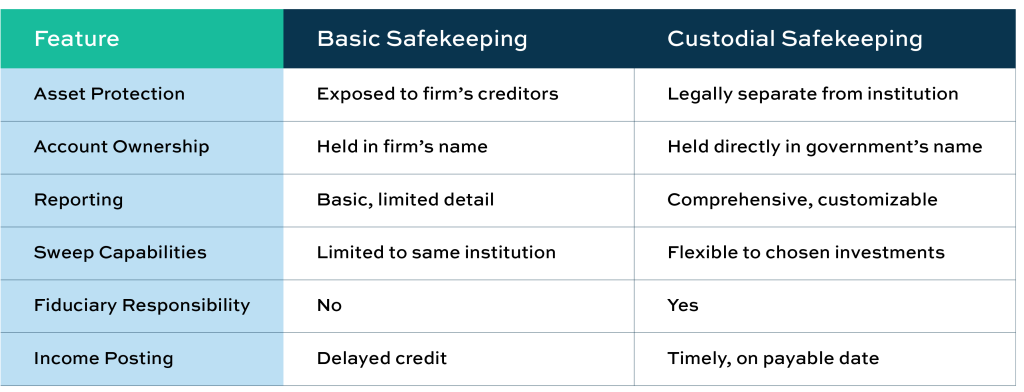

Below are the differences between Safekeeping and Custody. The objective is to help you understand the differences when making the decisions to utilize one of the services. We feel that Custody is a best practice and adds more value and protection to the investor.

Understanding Safekeeping vs. Custody Services

A safekeeping agreement typically involves a third-party firm handling the transfer and safekeeping of securities. This arrangement enables transactions to settle on a delivery-versus-payment (DVP) basis, ensuring simultaneous delivery and payment. However, safekeeping accounts do not protect against poor investment choices or defaulted securities.

Governments generally encounter two types of safekeeping arrangements:

- Basic Safekeeping Providers

- Custodial Safekeeping Providers

1. Basic Safekeeping Provider

Basic safekeeping services are often low-cost or free, bundled with other financial services. However, it’s crucial to understand the limitations of these arrangements:

- Assets are held in the firm’s name for the government’s benefit but are considered general assets of the firm

- Assets may be at risk of being used to satisfy the firm’s creditors in the event of financial trouble

- Accounts may be covered by SIPC insurance (up to $500,000), but this coverage excludes market value changes

- Sweep capabilities may be limited to accounts within the same financial institution

- Reporting is basic, with limited details and roll-up options

- Governments may face delays in accessing assets

2. Custodial Safekeeping Provider

Custodial providers, often housed within the Trust Department of a bank, operate under fiduciary responsibility and typically charge fees based on asset volume. These arrangements offer enhanced security and services:

- Asset Protection: Investment assets are legally separate from the institution and shielded from creditors

- Direct Account Ownership: Assets are held in the government’s name

- Cash Sweep Features: Automated overnight cash sweeps to preferred investment vehicles

- Trade Flexibility: Governments can use any broker or dealer for transactions

- Advanced Reporting: Includes customizable reporting and roll-ups for comprehensive tracking

- Timely Income Posting: Income is credited to accounts on the payable date

Comparison: Basic vs. Custodial Safekeeping Providers

Below is a graph comparing key features of Basic and Custodial Safekeeping Providers:

About Deep Blue Investment Advisors

At Deep Blue Investment Advisors, we specialize in helping government finance officers expand their horizons by diving into fixed-income management solutions with tangible results. Our team of experienced investment management professionals can help tailor a portfolio to your investment needs while providing regular reporting, portfolio compliance, and performance meetings. You can always count on us to prioritize our relationships, provide guidance, and act in your best interest.

To open an account or for more information, connect with one of our advisors today.

*This article is for informational purposes only. This report is prepared by Deep Blue Investment Advisors (“Deep Blue”). Deep Blue makes no representation or warranty, expressed or implied, regarding the accuracy or completeness of the information contained herein. The report is not meant as a solicitation of any investment offered by Deep Blue. The US-FIT investments are not available for sale to the general public and only to certain qualified entities.

Investments in the US-FIT Pools are not insured or guaranteed by the FDIC or any other government agency. The investment pools may invest in fixed-income securities subject